Hana’s forthcoming acquisition of KEB meets challenges

By Korea HeraldPublished : Jan. 29, 2012 - 19:47

Lender is set to emerge as second-largest financial group by total assets

Friday’s decision by the financial regulator to allow Hana Financial Group take over Korea Exchange Bank is set to impact the financial market in general and the credit card sector in particular, with Hana still to resolve a thorny integration issue.

The Financial Services Commission approved Hana’s bid to buy KEB from Lone Star Funds for 3.92 trillion won ($3.5 billion), allowing the U.S.-based fund to exit its eight-year investment in the local lender with a huge profit through the forthcoming stake sale.

Hana will emerge as the country’s second-biggest financial group by assets once the take-over process is complete, positioning itself as a heavyweight in the intensifying competition with other behemoths such as Woori, KB and Shinhan. Hana’s credit card operation is also expected to balloon instantly, taking up an 8 percent share after the merger.

Hana, however, is confronted with the hostile labor union of KEB as well as KEB employees who have protested the stake sale by Lone Star. Securing the takeover money is also a major challenge at a time when the broader Korean economy faces a slowdown due to the eurozone fiscal crisis and other negative factors.

The stake sale itself is tainted with disputes and public outcry. The U.S. buyout fund has been convicted of manipulating the stocks of KEB’s credit card unit, which prompted a group of lawmakers and civic groups to urge regulators to take punitive action against Lone Star. But the FSC stuck to its earlier position that there are no legal grounds for such action on the fund.

Friday’s decision by the financial regulator to allow Hana Financial Group take over Korea Exchange Bank is set to impact the financial market in general and the credit card sector in particular, with Hana still to resolve a thorny integration issue.

The Financial Services Commission approved Hana’s bid to buy KEB from Lone Star Funds for 3.92 trillion won ($3.5 billion), allowing the U.S.-based fund to exit its eight-year investment in the local lender with a huge profit through the forthcoming stake sale.

Hana will emerge as the country’s second-biggest financial group by assets once the take-over process is complete, positioning itself as a heavyweight in the intensifying competition with other behemoths such as Woori, KB and Shinhan. Hana’s credit card operation is also expected to balloon instantly, taking up an 8 percent share after the merger.

Hana, however, is confronted with the hostile labor union of KEB as well as KEB employees who have protested the stake sale by Lone Star. Securing the takeover money is also a major challenge at a time when the broader Korean economy faces a slowdown due to the eurozone fiscal crisis and other negative factors.

The stake sale itself is tainted with disputes and public outcry. The U.S. buyout fund has been convicted of manipulating the stocks of KEB’s credit card unit, which prompted a group of lawmakers and civic groups to urge regulators to take punitive action against Lone Star. But the FSC stuck to its earlier position that there are no legal grounds for such action on the fund.

Due to the controversial issues that remain unresolved, the tie-up of Hana and KEB is widely expected to be mired in lawsuits, injunctions and protests from KEB’s unionized workers and even political opposition.

Hana Financial’s total assets stood at 224 trillion won as of end-September last year. Given that KEB’s assets are 107 trillion won, the merged financial group would boast assets worth 331 trillion won, making it the country’s second-biggest after Woori Financial with 372 trillion won.

The bigger size, however, does not guarantee smooth sailing. The immediate task is to streamline its workforce. Hana Bank employs 9,335 workers, while KEB has 7,627 employees. The combined total of the two banks would reach 16,962, more than Woori Bank’s 14,999 workers and Shinhan Bank’s 14,329.

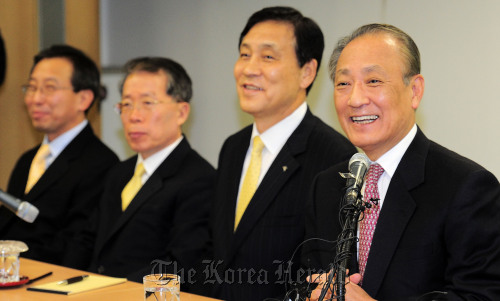

Restructuring seems to be an obvious choice, but Hana Financial chairman Kim Seung-yu said at a news conference held on Friday there won’t be any “artificial restructuring of the workforce” that reiterates the job security of KEB employees.

Kim has mapped out an interim structure in which two banks will retain their existing brands and organizations. In the long term, however, Hana has to integrate the overlapping branch offices and reduce its workforce to stay competitive.

Separately, whether Kim, 69, will keep his position once his term ends in March is an important factor that is generating speculation in the financial industry. As for his job, Kim did not reveal any clues, but market watchers said that he would likely renew his term.

Securing the take-over funds is a burden that will likely put pressure on Hana’s financial soundness. Last month, Lone Star agreed to cut the price for the KEB sale by 11 percent, a second reduction, but the final price is far from cheap for Hana.

By Yang Sung-jin (insight@heraldcorp.com)

-

Articles by Korea Herald

![[New faces of Assembly] Architect behind ‘audacious initiative’ believes in denuclearized North Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/01/20240501050627_0.jpg&u=20240502093000)