To infinity, and beyond: Hanwha enters global satellite race

Hanwha zeroes in on booming satellite internet market

By Kim Byung-wookPublished : Jan. 21, 2021 - 16:46

A new space race has begun in the US, as billionaire entrepreneurs Elon Musk and Jeff Bezos set out to launch thousands of small satellites to provide high-end internet coverage everywhere around the globe.

Although a late comer to the space in general, South Korea, too, has an ambitious player seeking to join the race -- the defense units of Hanwha Group.

At the forefront is Hanwha Aerospace, which manufactures aircraft components and commercial engine parts. The group announced last month a strategic investment, worth 58 billion won ($52.2 million), in a local satellite firm.

Hanwha Aerospace will acquire a 20 percent stake in Sartrec Initiative, with a plan to buy another 10 percent stake in the future, it said.

Launched in 1999, Sartrec is South Korea’s first satellite company, founded by former researchers from the Korea Advanced Institute of Science and Technology, who led the launch of the country’s first satellite “Our Star” in 1992.

“Hanwha Aerospace’s main business is aircraft engine components, but it also runs a satellite parts business. The move will allow the company to absorb Sartrec Initiative’s technology and expand its satellite business,” said Daishin Securities analyst Lee Dong-heon.

Sartrec Initiative is the nation’s sole developer and manufacturer of key satellite components, including satellite bodies, land systems and advanced Earth imaging sensors. It has exported products to Malaysia, Singapore, Turkey, Spain and the United Arab Emirates. The company logged revenue of 70.2 billion won and operating profit of 9.2 billion won in 2019.

Hanwha is looking for success in the same type of small craft as Musk and Bezos: low Earth orbit satellites.

These satellites operate from 500 kilometers to 2,000 kilometers above Earth’s surface whereas traditional communication satellites are stationed far higher, at roughly 36,000 kilometers. Such close distance allows LEO satellites to send and return data much faster and have the potential to rival or possibly exceed ground-based networks.

The global low Earth orbit satellite market is expected to almost triple to $7.1 billion by 2025 from this year’s $2.8 billion according to US market researcher ReportLinker.

Putting the pieces together

Sartrec’s satellite is likely to offer the last piece of puzzle for Hanwha Group’s pursuit of the LEO satellite business.

Hanwha has experience in manufacturing rockets for sending satellites into space. For the country’s first space launch vehicle “Naro,” Hanwha’s machinery defense division and machinery division -- which later became today’s Hanwha Aerospace -- participated in the development and manufacture of Naro’s upper propulsion unit, consisting primarily of a kick motor and a thrust vector control system.

Building on Naro’s successful launch in 2013, Hanwha Aerospace is currently developing a liquid rocket engine for the nation’s first fully indigenous carrier rocket “Nuri.” If two test launches in October this year and May next year turn out to be successful, Korea will send a satellite into the orbit using Nuri.

Hanwha Aerospace’s engineering strength has been recognized once again on Tuesday, when it received the world’s first quality certification from British aerospace engine maker Rolls-Royce. All Rolls-Royce suppliers have their products checked by the company before mass production, but now, Hanwha Aerospace can conduct its own quality control tests. Among hundreds of Rolls-Royce suppliers, Hanwha Aerospace has become the first to obtain such authorization, the Korean corporation said.

“Hanwha Aerospace is expected to create synergies with Hanwha Defense, who can manufacture launch pads, and Hanwha Corp., which is engaged in solid fuel business,” analyst Lee said.

In July, Korea and the US adopted the 2020 revised missile guidelines, which included a complete lifting of a ban on the use of solid fuels for space launches in Korea.

While Hanwha Aerospace is in full throttle developing satellites and carrier rockets, its defense radar and information technology service subsidiary Hanwha Systems is preparing a satellite telecommunications business.

Last month, Hanwha Systems said it would invest $30 million into US-based communications firm Kymeta, which manufactures antennas and systems capable of linking up with low Earth orbit satellites. The investment came after Kymeta closed an $85 million funding round in August, led by Bill Gates.

“The objective of our investment in Kymeta is to enter the low Earth orbit satellite antenna market early on, and diversify our technology portfolio,” said Hanwha Systems CEO Kim Youn-chul.

Kymeta’s antennas and systems connect networks on the ground with low Earth orbit satellites, offering seamless and uninterrupted mobile satellite-cellular connectivity for clients on the move.

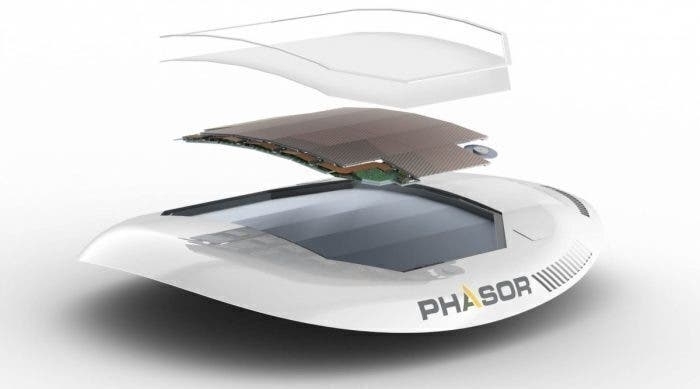

In June, Hanwha Systems also acquired Phasor Solutions, a UK-based satellite communication antenna developer, to secure key technology for broadband satellite internet service.

Mounted on aircraft, ships, trains and vehicles, Phasor Solutions’ satellite communication antennas enable stable, high-speed communication, transmission and reception with low Earth orbit satellites.

The acquisition will allow Hanwha Systems to secure experts in Phasor Solutions and source technologies of its next-generation semiconductor-based satellite antennas.

By Kim Byung-wook (kbw@heraldcorp.com)

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)