[Market Eye] Hyundai Motor’s succession plan a headache to Hyundai Card

Should Hyundai Card leave Hyundai Motor, card issuer likely to face increased debt financing costs, experts say

By Son Ji-hyoungPublished : Sept. 16, 2021 - 16:15

With the independence of Hyundai Motor Group’s financial arms looking increasingly likely, concerns are growing that they will face higher debt financing costs as a result.

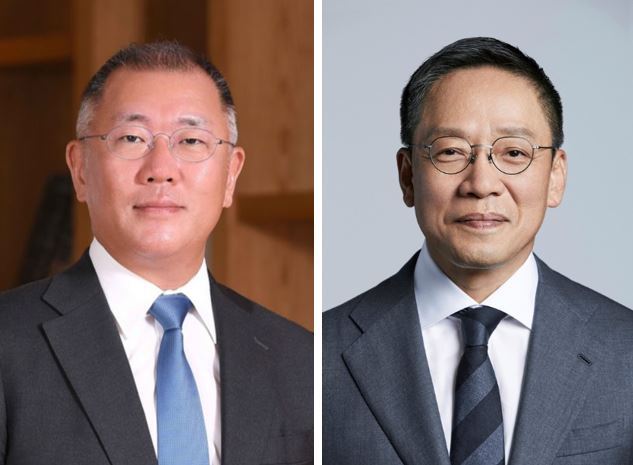

The prospects have been raised amid signs of governance restructuring for Hyundai Motor Group to allow a full-fledged family succession that would consolidate Chairman Chung Euisun’s control.

A carve-out of financial arms is essential to Hyundai Motor Group’s transformation into a holding firm under Korea’s antitrust rules. The Korean law describes the doctrine of separation of industrial and financial capital, banning a nonfinancial conglomerate with a holding company structure from owning a stake in a financial services company.

But a separation might raise the cost of debt financing at home and abroad for Hyundai Motor’s financial affiliates.

The credit ratings of Hyundai Card and Hyundai Capital -- the key factor to determine the credit quality and debt financing cost -- depend strongly on institutional support from the group’s flagship carmaker Hyundai Motor.

Hyundai Card is a consumer finance firm, while Hyundai Capital Services is dedicated to auto financing.

The two firms’ credit ratings for senior debts by Korean credit rating agencies -- Nice Investors Service, Korea Investors Service and Korea Ratings -- were downgraded in late 2019 from AA+ to AA, in tandem with the downgrading of Hyundai Motor and Kia. Hyundai Card and Hyundai Capital’s ratings have yet to recover.

Global credit rating agency Fitch Ratings has given Hyundai Card a BBB rating and Hyundai Capital a BBB+ rating since 2012. But its analysts say that the financial arms’ independence from the conglomerate might lead to a reassessment.

“Our view of the parent’s high propensity to support Hyundai Card is driven by the card operator’s close linkages to the group,” said Matt Choi, director of APAC banks at Fitch Ratings.

Choi added that Fitch forecast the group’s controlling ownership of Hyundai Card to continue for at least over the next 18 months.

“Should the group’s ownership be reduced noticeably for whatever reason, we would reassess its linkages to the group to decide whether the parent’s propensity to support has indeed reduced,” he said.

The total amount of financing of Hyundai Card came to 14.9 trillion won ($12.7 billion) as of end-June, with the domestic financing amounting to some 90 percent, according to the company. Hyundai Capital’s stood at 27.4 trillion won.

The Hyundai Motor chairman is seen to be laying the groundwork to take control of the auto-to-construction conglomerate. At the same time, the group is seeking to resolve the circular cross-shareholding structure to boost transparency, in a restructuring drive that was first announced in 2018.

One of the examples is Hyundai Engineering’s imminent initial public offering, at which the company hopes to target 10 trillion won in equity value. This is regarded as a way for Hyundai Motor Group Chairman Chung to secure cash, with the proceeds likely to be used to increase his stake in what could be the group’s holding company, or to pay taxes that would arise from changes of ownership, such as gift tax.

Chung owns an 11.72 percent stake in Hyundai Engineering, with other stakes held by Hyundai Engineering & Construction, Hyundai Glovis, Kia and Hyundai Mobis.

Hyundai Engineering has yet to apply for the market debut to the stock bourse operator, the Korea Exchange.

Governance restructuring is also underway within Hyundai Motor’s financial arms, including a consolidation of Vice Chairman Chung Tae-young’s management influence over companies he and his wife Chung Myung-yi have stakes in -- corporate financing arm Hyundai Commercial.

The brother-in-law of Hyundai Motor Group Chairman Chung offered to step down earlier in September from Hyundai Capital, and pledged to focus on two other affiliates -- Hyundai Commercial and Hyundai Card.

Chung and his wife Chung own a combined 37.5 percent in Hyundai Commercial, and Hyundai Commercial holds some 30 percent in Hyundai Card.

In the meantime, the credit industry’s subdued growth in Korea is putting Hyundai Card’s IPO plan in disarray, as the company said it has no plan to conduct an IPO in the wake of a change of its shareholders to Taiwan-based Fubon.

Hyundai Card has declined to comment on the implications of Chung’s retirement from the Hyundai Capital post or the group’s family succession plan.

The prospects have been raised amid signs of governance restructuring for Hyundai Motor Group to allow a full-fledged family succession that would consolidate Chairman Chung Euisun’s control.

A carve-out of financial arms is essential to Hyundai Motor Group’s transformation into a holding firm under Korea’s antitrust rules. The Korean law describes the doctrine of separation of industrial and financial capital, banning a nonfinancial conglomerate with a holding company structure from owning a stake in a financial services company.

But a separation might raise the cost of debt financing at home and abroad for Hyundai Motor’s financial affiliates.

The credit ratings of Hyundai Card and Hyundai Capital -- the key factor to determine the credit quality and debt financing cost -- depend strongly on institutional support from the group’s flagship carmaker Hyundai Motor.

Hyundai Card is a consumer finance firm, while Hyundai Capital Services is dedicated to auto financing.

The two firms’ credit ratings for senior debts by Korean credit rating agencies -- Nice Investors Service, Korea Investors Service and Korea Ratings -- were downgraded in late 2019 from AA+ to AA, in tandem with the downgrading of Hyundai Motor and Kia. Hyundai Card and Hyundai Capital’s ratings have yet to recover.

Global credit rating agency Fitch Ratings has given Hyundai Card a BBB rating and Hyundai Capital a BBB+ rating since 2012. But its analysts say that the financial arms’ independence from the conglomerate might lead to a reassessment.

“Our view of the parent’s high propensity to support Hyundai Card is driven by the card operator’s close linkages to the group,” said Matt Choi, director of APAC banks at Fitch Ratings.

Choi added that Fitch forecast the group’s controlling ownership of Hyundai Card to continue for at least over the next 18 months.

“Should the group’s ownership be reduced noticeably for whatever reason, we would reassess its linkages to the group to decide whether the parent’s propensity to support has indeed reduced,” he said.

The total amount of financing of Hyundai Card came to 14.9 trillion won ($12.7 billion) as of end-June, with the domestic financing amounting to some 90 percent, according to the company. Hyundai Capital’s stood at 27.4 trillion won.

The Hyundai Motor chairman is seen to be laying the groundwork to take control of the auto-to-construction conglomerate. At the same time, the group is seeking to resolve the circular cross-shareholding structure to boost transparency, in a restructuring drive that was first announced in 2018.

One of the examples is Hyundai Engineering’s imminent initial public offering, at which the company hopes to target 10 trillion won in equity value. This is regarded as a way for Hyundai Motor Group Chairman Chung to secure cash, with the proceeds likely to be used to increase his stake in what could be the group’s holding company, or to pay taxes that would arise from changes of ownership, such as gift tax.

Chung owns an 11.72 percent stake in Hyundai Engineering, with other stakes held by Hyundai Engineering & Construction, Hyundai Glovis, Kia and Hyundai Mobis.

Hyundai Engineering has yet to apply for the market debut to the stock bourse operator, the Korea Exchange.

Governance restructuring is also underway within Hyundai Motor’s financial arms, including a consolidation of Vice Chairman Chung Tae-young’s management influence over companies he and his wife Chung Myung-yi have stakes in -- corporate financing arm Hyundai Commercial.

The brother-in-law of Hyundai Motor Group Chairman Chung offered to step down earlier in September from Hyundai Capital, and pledged to focus on two other affiliates -- Hyundai Commercial and Hyundai Card.

Chung and his wife Chung own a combined 37.5 percent in Hyundai Commercial, and Hyundai Commercial holds some 30 percent in Hyundai Card.

In the meantime, the credit industry’s subdued growth in Korea is putting Hyundai Card’s IPO plan in disarray, as the company said it has no plan to conduct an IPO in the wake of a change of its shareholders to Taiwan-based Fubon.

Hyundai Card has declined to comment on the implications of Chung’s retirement from the Hyundai Capital post or the group’s family succession plan.

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)